Independent Contractor or Employee?

Do you hire or work with other employees? Do you hire or work with independent contractors? Whichever you do, it is important to make sure you, and those you work with or hire, are properly insured.

While hiring “independent contractors” rather than “employees”, can save money on workers’ compensation insurance as well as state and federal taxes, you risk considerable tax fines, other penalties, and a serious insurance coverage gap if your “independent contractors” are later determined to actually fit an “employee” definition.

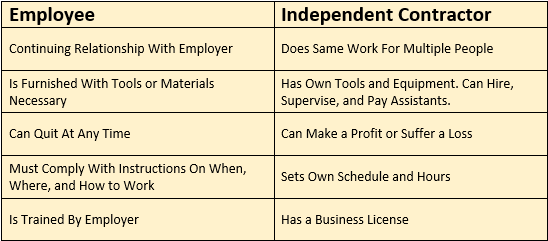

So how does one know the difference between the two? The chart below shows a few of the differences between an employee and an independent contractor. Remember, if even one of the independent contractor criteria is not met, the worker may be considered an employee.

Previously, it was easy to distinguish an employee from an independent contractor because an employee had withholdings taken from their paycheck and an independent contractor did not. That all changed when the IRS realized they were losing over $30 billion dollars a year in tax revenue due to employee/independent contractor misclassification.

Today it is extremely important to correctly classify those you work with, not only to avoid IRS penalties and back taxes, but to also remove the risk of serious financial loss if an injured independent contractor is determined to actually be an employee and you failed to carry workers’ compensation insurance.

Most standard general liability policies will protect you from lawsuits for injuries to independent contractors, but none will provide you protection for injuries to employees.

Only a workers’ compensation policy does that.

In today’s litigious society any protection against the open-ended damages that a court might award is a valuable benefit. For employers, one of the key advantages of workers’ compensation laws is the limitation on the right of the injured employee to sue the employer. In effect, employers makes a trade with employees – the employees automatically receive benefits for being injured on the job, even if the injury was partially or entirely the employees’ fault, and the employees gives up the right to sue to recover damages for those injuries in court, even if the employer was at fault.

In the case of independent contractors, no workers’ compensation benefits are received, which means that there is no limitation on their ability to sue the employer for whatever damages the court will award. In effect, when employers elect to use independent contractors instead of employees, they are trading immediate and limited savings on workers’ compensation premiums for exposure to legal damages which could easily exceed the normal general liability policy limit of $1,000,000!

So how can you protect yourself and your business when hiring independent contractors?

– If you occasionally contract with another DJ/KJ/VJ company (Independent Contractor or subcontractor) to perform at a venue on your behalf, have the independent contractor name you and your DJ/KJ/VJ company as a ‘Additional Insured’ on a Certificate Of Insurance with at least $1,000,000 of liability insurance.

– Whether you think you have employees or not, buy a workers’ compensation policy, along with your general liability policy. Don’t wait until an injury to find out who you thought was an independent contractor has been determined to be an employee and you didn’t buy workers’ compensation insurance.

– Make certain independent contractors have their own workers’ compensation insurance and be sure to ask for proof of the insurance.